What's in our basket

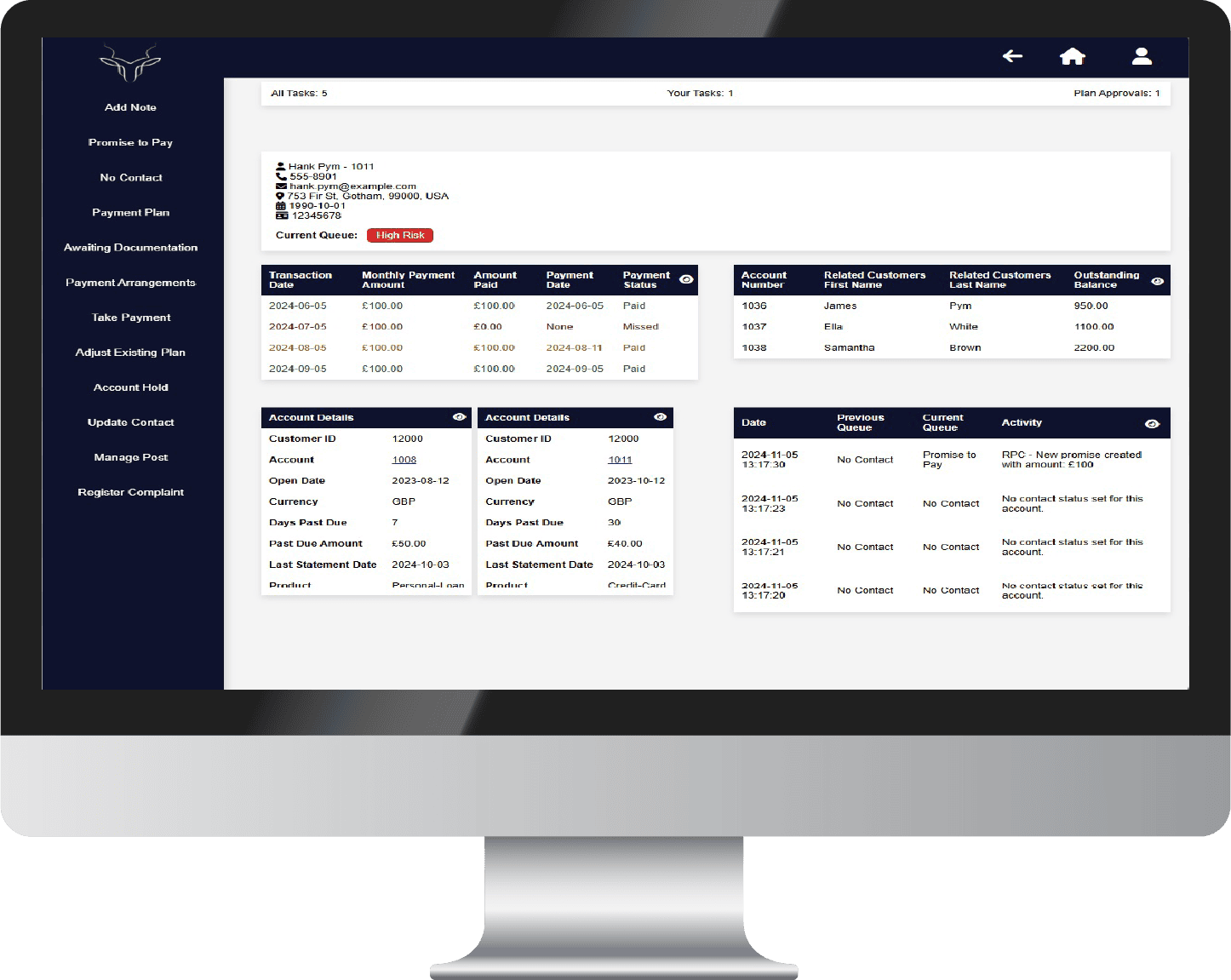

Kudu.Collect

/Light

Easy to onboard and use the preconfigured collection processes in case it's not your key expertise, but you need to automate the related activities to keep them transparent.

Best fit to all organisations who do not build up their own competency for managing overdue receivables, therefore can see the benefit in a straightforward and efficient tool which delivers built-in business competence.

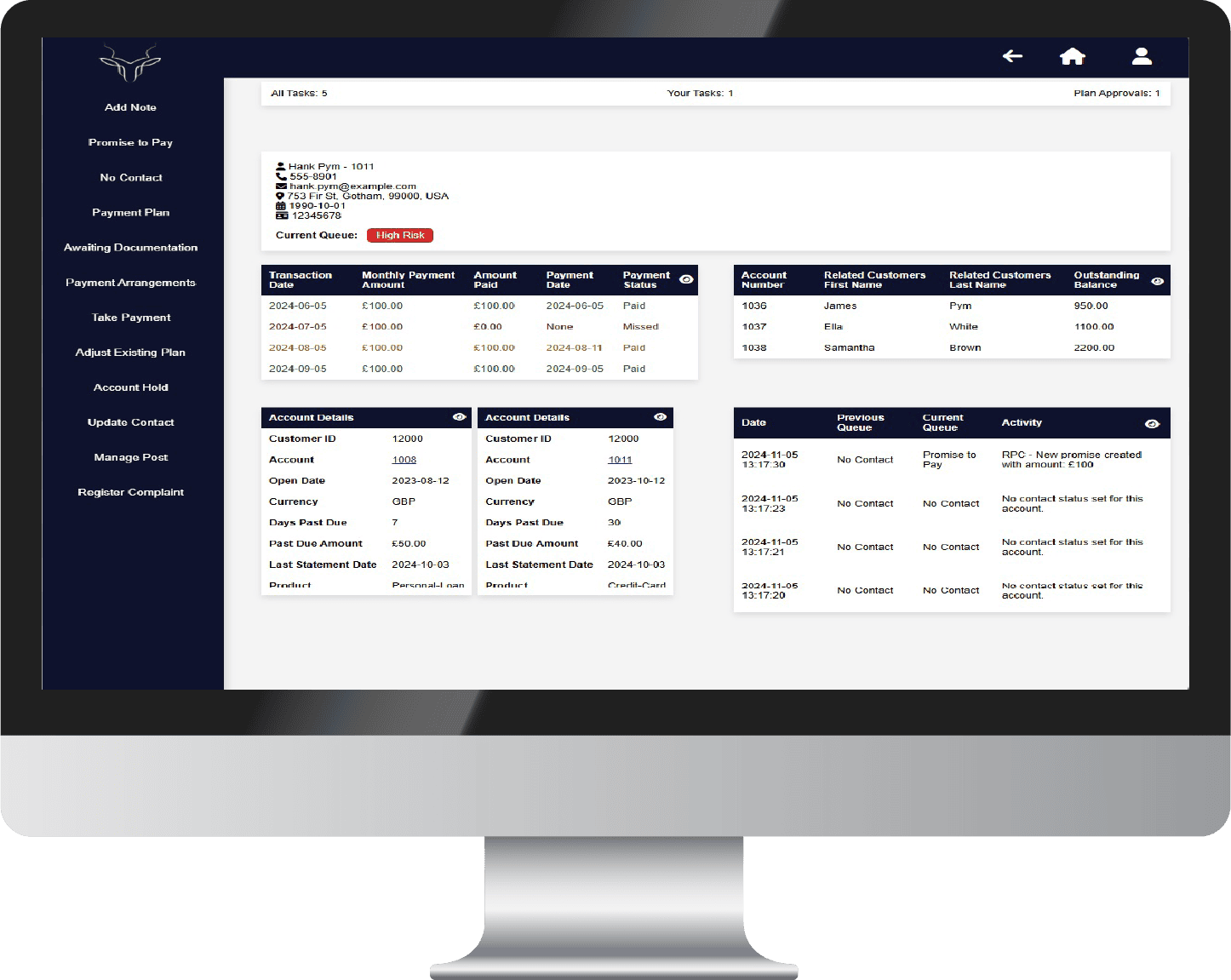

Kudu.Collect

/Standard

Or modular approach to cover the needs of specialised collection activities focusing on specific industries, customer types, products and stages of the debt management process.

Best fit for organisations whose core activity is any form of lending or mass service providing, therefore naturally face the growing number of non-payer customers - they will appreciate the system's relevant domain competence.

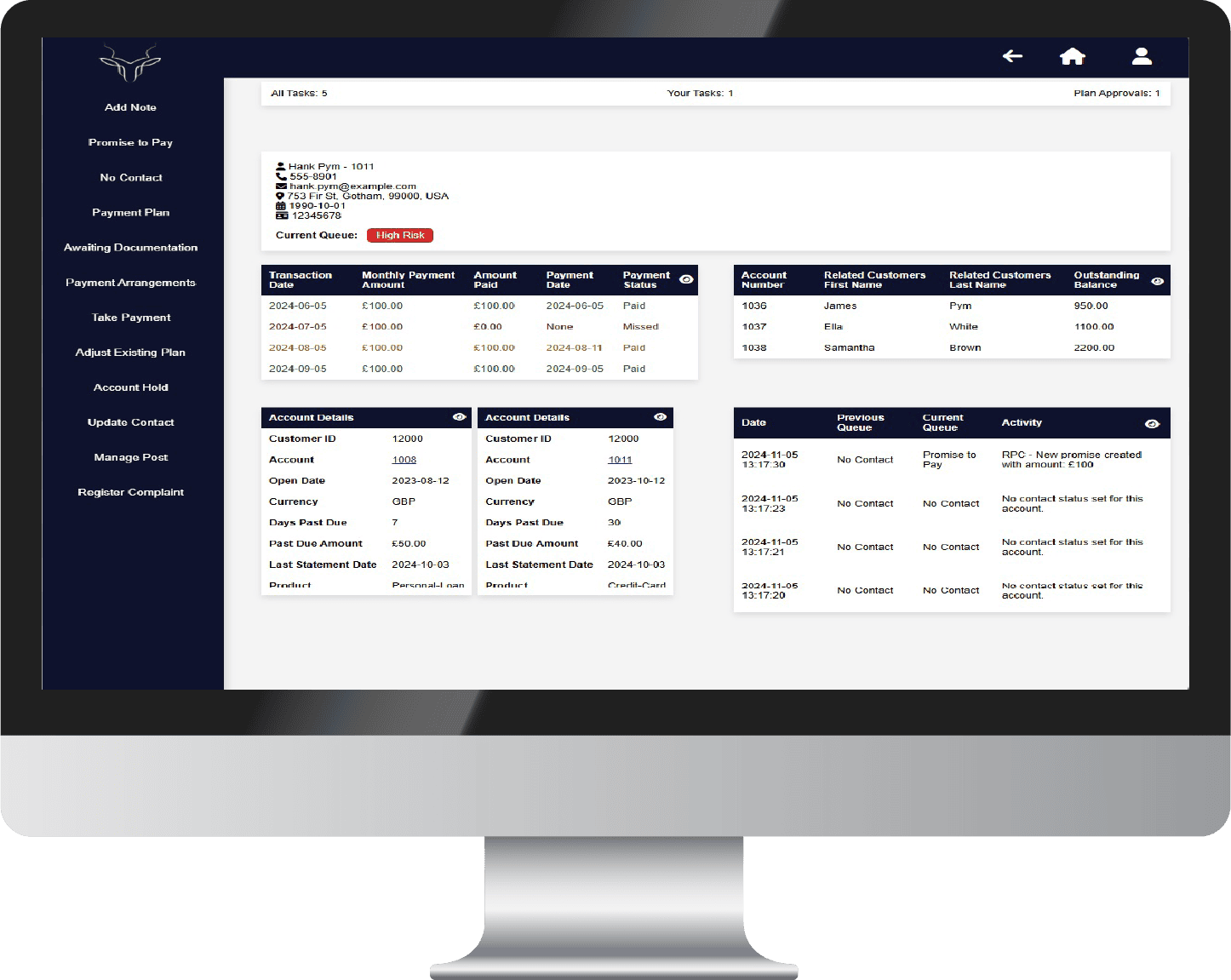

Kudu.Collect

/Enterprise

Full scale end-to-end collection and recovery platform accommodating all business lines and features with customisable integration and user experience - meeting the requirements of complex organisations dealing with any type and level of debt management.

Best fit to commercial banks and debt collection agencies, whose specific requirements typically cannot be found in out of the box products.

We'd love to work with you

Kudu.Digital is an ambitious and stable fintech with a huge experience in understanding what is needed to support the growth of businesses.

Our solutions are a great match for growing companies, scaling up with your needs all through your journey.

The vision behind Kudu.Digital

Professionals from diverse and complementary backgrounds came together with a shared ambition to redefine the debt collection industry. With extensive experience spanning software development, banking, debt management, investment, and AI technology, they had seen firsthand the inefficiencies and frustrations inherent in traditional approaches. Together, they decided to pool their expertise and insights to create something transformative.

The result was Kudu.Digital, a cutting-edge fintech company designed to challenge outdated practices and set a new benchmark for the industry. Their vision was to leverage AI-powered, cloud-based technology to deliver solutions that seamlessly integrate with both customer and business needs. The platform would empower many types of businesses to easily join, understand, and manage their outstanding debts at any stage, fostering a user-friendly and transparent experience.

For businesses, Kudu.Digital offers a powerful suite of tools to optimize operations, streamline collections, and enhance recovery rates, all while maintaining a customer-centric approach. The founders’ combined expertise ensures that the platform not only meets current demands but also anticipates future challenges, setting the stage for a more efficient, ethical, and innovative debt management ecosystem. Kudu.Digital aims to lead the industry into a smarter, more connected future, bridging the gap between technology and trust.

We love our job, such as You do.

Let's connect!

Message us

Registered in UK.

Available globally.

LinkedIn: kududigital

Website: kudu.digital

Email: info@kudu.digital